5

UNMANNED AIRCRAFT SYSTEMS IN RUSSIA’S AGRICULTURAL SECTOR

According to the adopted strategy for the development of unmanned aerial systems, by 2030, the number of UAVs sold in the Russian Federation market is estimated to exceed 180,000 units, and around 200,000 units by 2035. In monetary terms, these volumes correspond to nearly 200 billion rubles and more than 220 billion rubles, respectively [2].

The strategy adopted by the Russian Federation envisages systematization and scaling of production. It is planned to nearly double the volume of the Russian market for heavy and medium UAVs by 2030, based on the formation of an industrial software base, infrastructure, support for demand from government agencies, regions, and state companies, up to the development of relevant scientific and technological competencies, design capabilities, and the domestic engineering school [44].

According to expert estimates, agricultural drones account for more than 5% of the civil UAV market in Russia, which amounts to 1.5-2 billion rubles per year [45]. Currently, most of the UAVs used in Russian agriculture are of Chinese production or assembled using Chinese components and software. The potential market for agricultural drones in Russia is much larger and could reach 50,000 UAVs per year. Such demand for agricultural drones, provided there is support at all levels of government, could be achieved within three years [46]. Realizing this potential will largely depend on the initiative of the federal authorities and how the national project for the development of UAVs is implemented. The national project “Unmanned Aerial Systems,” which aims to create conditions for a significant breakthrough in this direction, was approved on December 26, 2023. The financing from the federal budget until 2030 will amount to 696 billion rubles. By the end of this period, it is expected that 32,500 civil UAVs (weighing over 1 kg) will be produced annually [47] (Figure 5.4). However, as of July 2024, the national project for UAV development is being implemented with delays, due to the low willingness of some stakeholders to take responsibility for decisions in the context of manual industry management and the passive wait-and-see attitude of a number of participants.

UAVs in Russian agriculture represent one of the most promising areas. In the interests of precision farming, both unmanned aerial vehicles and software are continuously being developed and improved to quickly collect and process the acquired data, create technological maps and task lists for production operations, and carry out these operations using highly automated equipment, including UAVs.

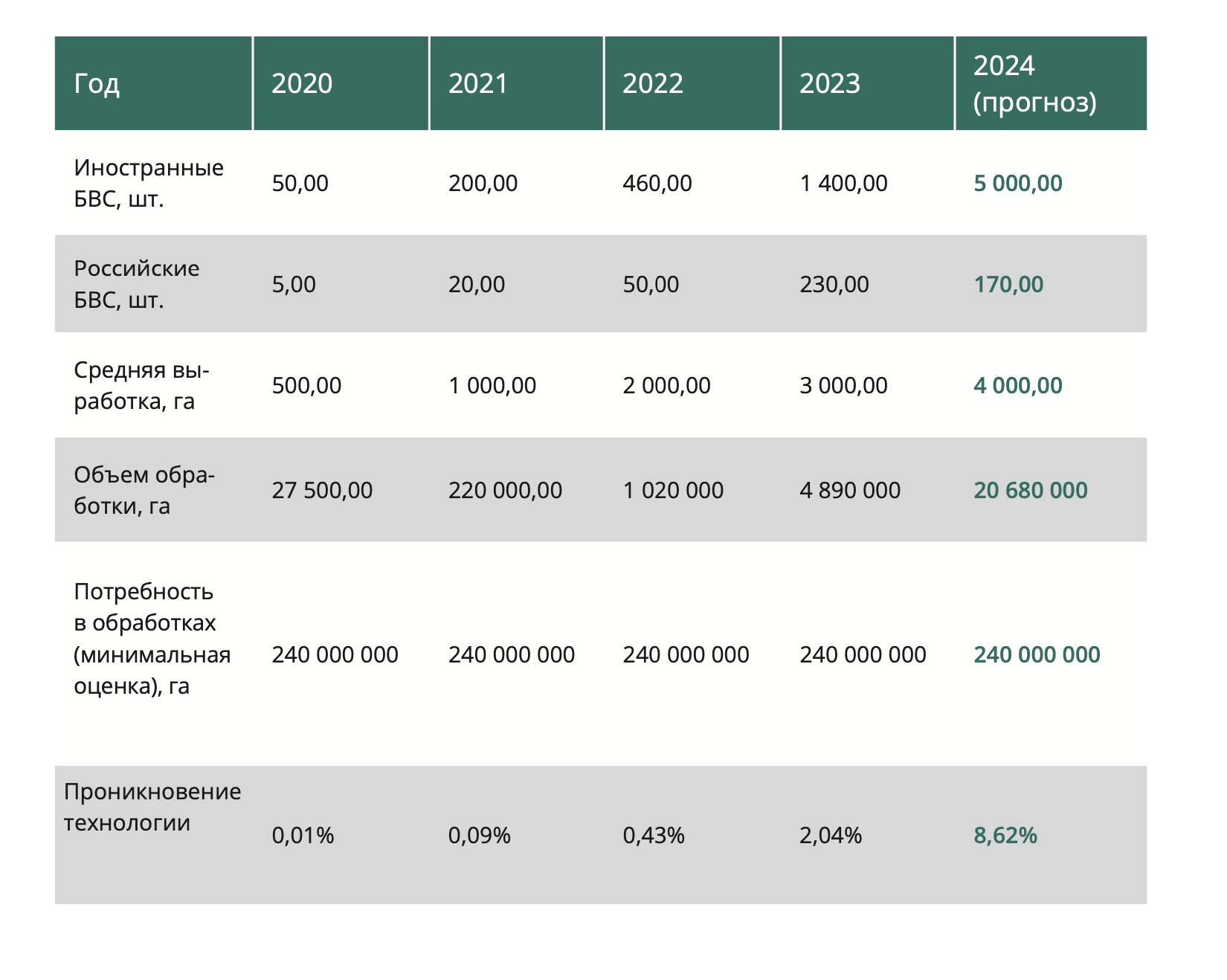

Until 2020, drones used in the agricultural sector were predominantly spatial data drones, which were used to quickly obtain up-to-date information on the condition of crops, detect irregularities in agricultural areas, and assess the quality of fields. Since 2021, the use of agricultural drones for applying plant protection products has been rapidly expanding in Russia.

The Ministry of Agriculture of Russia is currently implementing state support measures for agricultural producers to purchase UAVs:

1. Under the Rules for granting subsidies from the federal budget to the joint-stock company “Rosagrolizing” to compensate for lost income when the lessee makes lease payments under financial lease agreements (leasing), concluded under preferential (special) conditions approved by the Resolution of the Government of the Russian Federation dated August 31, 2019, No. 1135, subsidies are provided for the acquisition of agricultural machinery, equipment, and technology, including UAVs for agriculture, on preferential lease terms for agricultural producers and organizations providing services to them.

2. The Ministry of Agriculture of Russia issued Order No. 568 on June 14, 2023, “On Amending the Order of the Ministry of Agriculture of the Russian Federation No. 274 dated May 4, 2022,” which, in particular, provides for the possibility of granting preferential investment loans for a term of 2 to 5 years, including for the purchase of UAVs, including those using technologies based on artificial intelligence.

As part of its duties, the Ministry of Agriculture of Russia utilizes unmanned aerial systems (UAS) to address various tasks, including:

• Ensuring the educational process and scientific-technical development of the industry.

• Collecting and transmitting data.

• Conducting remote monitoring.

• Applying and spraying liquid, powdery, and gaseous substances, biological agents, and other forms of plant protection.

• Performing aerological logistics.

• Supporting construction and installation works.

• Providing local protection for objects.

• Carrying out sanitary pruning of plantings.

• Engaging in fire-fighting activities.

UAS are used in salmon farms in different regions of the Russian Far East to collect primary data on the distribution of salmon producers. They help gather information on the scale of salmon runs and the occupancy of spawning grounds, including in hard-to-reach areas. UAS are also used in monitoring studies of herring spawning grounds and assessing the status of marine mammal populations. UAS can be effectively used for economical monitoring of fish, mammals, bottom vegetation, fishing, and landscape mapping.

The Federal State Budgetary Institution “Rosagrozemmonitoring” uses UAS to monitor agricultural lands in Russia to verify data on the preservation and involvement of lands in agricultural production.

5.1

ADVANTAGES OF AGRODRONES FOR THE RUSSIAN MARKET

The rapid growth of the agricultural drone fleet is driven both by the objective process of technological improvement and by subjective changes in farmers’ understanding of the benefits of using unmanned aerial systems (UAS), leading to a conscious demand for such services.

Technological advancement is associated with the introduction of agricultural drone models with payloads of 30 kilograms or more. Earlier models could only carry much smaller amounts of applied substances – 10 to 16 kilograms – which, given the specifics of the Russian agricultural sector, was often insufficient for covering large areas, thereby limiting their area of application. However, even drones with a payload capacity of 10 to 20 kilograms helped establish the practice of their use and created a positive perception among agricultural producers.